azs-2022.ru

News

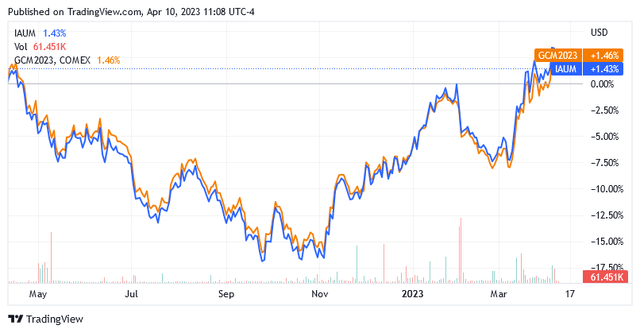

Ishares Gold Trust Micro

IAUM. iShares Gold Trust Micro ETF of Benef Interest. Pricing Data. $ IAUM, iShares Gold Trust Micro - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. IAUM is an efficient way for investors to hold physical gold by providing exposure to the day-to-day movement of the price of gold bullion. The fund removes the. iShares Gold Trust Micro. ETF. IAUM. Price as of: AUG 19, PM EDT. $ - $ - %. Primary Theme. N/A. fund company. N/A. Snapshot. Profile. iShares® Gold Trust Micro (IAUM) Find here information about the iShares Gold Trust Micro ETF (IAUM). Assess the IAUM stock price quote today as well as the. How much percentage Ishares Gold Trust Micro is up from its 52 Week low? Market News: Market Today. Popular Index and Categories: Stocks in Indian Share. IAUM | A complete iShares Gold Trust Micro exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Discover historical prices for IAUM stock on Yahoo Finance. View daily, weekly or monthly format back to when iShares Gold Trust Micro stock was issued. Learn everything you need to know about iShares® Gold Trust Micro (IAUM) and how it ranks compared to other funds. Research performance, expense ratio. IAUM. iShares Gold Trust Micro ETF of Benef Interest. Pricing Data. $ IAUM, iShares Gold Trust Micro - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. IAUM is an efficient way for investors to hold physical gold by providing exposure to the day-to-day movement of the price of gold bullion. The fund removes the. iShares Gold Trust Micro. ETF. IAUM. Price as of: AUG 19, PM EDT. $ - $ - %. Primary Theme. N/A. fund company. N/A. Snapshot. Profile. iShares® Gold Trust Micro (IAUM) Find here information about the iShares Gold Trust Micro ETF (IAUM). Assess the IAUM stock price quote today as well as the. How much percentage Ishares Gold Trust Micro is up from its 52 Week low? Market News: Market Today. Popular Index and Categories: Stocks in Indian Share. IAUM | A complete iShares Gold Trust Micro exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Discover historical prices for IAUM stock on Yahoo Finance. View daily, weekly or monthly format back to when iShares Gold Trust Micro stock was issued. Learn everything you need to know about iShares® Gold Trust Micro (IAUM) and how it ranks compared to other funds. Research performance, expense ratio.

IAUM ISHARES GOLD TRUST MICRO · High. · Low. · Volume. M · Open. · Pre Close. · Turnover. M · Turnover Ratio. % · P/E . Complete iShares Gold Trust Micro funds overview by Barron's. View the IAUM funds market news. Real-time Price Updates for Ishares Gold Trust Micro ETV Shares (IAUM-A), along with buy or sell indicators, analysis, charts, historical performance. iShares® Gold Trust Micro (IAUM) is a passively managed Commodities Commodities Focused exchange-traded fund (ETF). iShares launched the ETF in The. IAUM – iShares® Gold Trust Micro – Check IAUM price, review total assets, see historical growth, and review the analyst rating from Morningstar. View ISHARES GOLD TRUST MICRO (IAUM) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Table of Contents Filed Pursuant to Rule (b)(3) Registration No. PROSPECTUS iShares® Gold Trust Micro The iShares Gold Trust Micro (the. iShares Gold Trust Micro This ETF provides physical exposure, by owning its shares you earn the return of the securities composing the index (as the ETF holds. Can Fractional shares of Ishares Gold Trust Micro be purchased? plus_minus_icon. What are the documents required to start investing in Ishares Gold Trust Micro. Get the latest iShares Gold Trust Micro (IAUM) fund price, news, buy or sell recommendation, and investing advice from Wall Street professionals. The iShares Gold Trust Micro (the “Trust”) issues shares (“Shares”) representing fractional undivided beneficial interests in its net assets. iShares Gold Trust Micro is an exchange traded fund launched and managed by iShares Delaware Trust Sponsor LLC. The fund invests in the commodity markets. Get the latest iShares Gold Trust Micro (IAUM) real-time quote, historical performance, charts, and other financial information to help you make more. Get iShares Gold Trust Micro (IAUM:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. The iShares Gold Trust Micro ETF of Benef Interest (IAUM) is an exchange-traded fund that is based on the LBMA Gold Price index. The fund tracks the gold. About iShares Gold Trust Micro (IAUM). Sector: Financial Services. Industry: Asset Management. Headquarters: San Francisco, CA USA. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for iShares Gold Trust Micro ETF of Benef Interest (IAUM). iShares® Gold Trust Micro. The iShares Gold Trust Micro (the “Trust”) issues shares (“Shares”) representing fractional undivided beneficial interests in its. Performance charts for iShares Gold Trust Micro (IAUM - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Get comprehensive information about iShares Gold Trust Micro (USD) (USF) - quotes, charts, historical data, and more for informed investment.

Best Mortgage Type

Typical mortgage terms are for 15 or 30 years. Mortgages are also known as liens against property or claims on property. If the borrower stops paying the. A fixed-rate loan makes it easier to create and stick to a budget. Additionally, this loan type makes it easier to plan your future as life changes occur, which. Most borrowers choose fixed-rate mortgages. Your monthly payments are more likely to be stable with a fixed-rate loan, so you might prefer this option if you. Conventional Fixed Rate Mortgages Conventional Loan Pros and Cons. A mortgage in which the interest rate remains the same throughout the entire life of the. Find your home loan · Adjustable-Rate Mortgage · Fixed Rate Mortgage · FHA Loans · VA Home Loans · ITIN Home Loans · Construction Home Loans · USDA Home Loans · Reverse. True North Mortgage is one of Canada's leading mortgage brokers, with the lowest mortgage rates. Apply online or visit one of our locations! Which Home Loan is Right for You? · Fixed Rate Mortgages · Adjustable Rate Mortgages (ARM) · Jumbo Loans · FHA Loans · USDA Loans · VA Loans · Doctor/Physician Loans. Types of Home Loans · Low Down Payment Loans. Low down payment mortgages for every home buyer · Conventional And Conforming Loans. Conventional loan requirements. If the property has extra space, you can use potential boarder or rental income to help you qualify for the loan. Best for: Borrowers with a credit score of at. Typical mortgage terms are for 15 or 30 years. Mortgages are also known as liens against property or claims on property. If the borrower stops paying the. A fixed-rate loan makes it easier to create and stick to a budget. Additionally, this loan type makes it easier to plan your future as life changes occur, which. Most borrowers choose fixed-rate mortgages. Your monthly payments are more likely to be stable with a fixed-rate loan, so you might prefer this option if you. Conventional Fixed Rate Mortgages Conventional Loan Pros and Cons. A mortgage in which the interest rate remains the same throughout the entire life of the. Find your home loan · Adjustable-Rate Mortgage · Fixed Rate Mortgage · FHA Loans · VA Home Loans · ITIN Home Loans · Construction Home Loans · USDA Home Loans · Reverse. True North Mortgage is one of Canada's leading mortgage brokers, with the lowest mortgage rates. Apply online or visit one of our locations! Which Home Loan is Right for You? · Fixed Rate Mortgages · Adjustable Rate Mortgages (ARM) · Jumbo Loans · FHA Loans · USDA Loans · VA Loans · Doctor/Physician Loans. Types of Home Loans · Low Down Payment Loans. Low down payment mortgages for every home buyer · Conventional And Conforming Loans. Conventional loan requirements. If the property has extra space, you can use potential boarder or rental income to help you qualify for the loan. Best for: Borrowers with a credit score of at.

Among the most popular types of mortgages are conventional and government-backed loans. That is, FHA, VA and USDA. What Is The Easiest Type Of Mortgage To Get? These mortgages are great for either a short term solution to avoid pre-payment penalties. The freedom in an open mortgage means that it will come with much. Mortgages with lower down payments · Chase DreaMaker℠ mortgage · Chase DreaMaker℠ mortgage · Federal Housing Administration (FHA) loan · Federal Housing. Your Loan Officer will explain your options and deliver a mortgage with the best loan terms available. What type of property are you looking to refinance? 10 Different Types of Mortgage Loans Homebuyers Should Know About · 2. Fixed-rate mortgages · 3. Adjustable-rate mortgages · 4. High-balance loans · 6. FHA loans · 7. The traditional year fixed-rate mortgage has a constant interest rate and monthly payments that never change. This may be a good choice if you plan to stay. Which type of mortgage best fits my needs? ; Conventional fixed-rate loans · Plan to stay in your home for a long time; Have an established credit history; Can. Fixed-rate mortgages · If you plan on owning your home for a long time (generally 7 years or more) · If you think interest rates could rise in the next few years. Answer a few simple questions in our interactive video to see what type of home loan works best for you. Conventional loans are a good choice for most borrowers who want to take advantage of lower interest rates with a larger down payment. Pros of Conventional. Those with a steady income, who don't have other significant debts are the best candidates for a year, fixed-rate loan. Since the loan amount is shorter, the. Home loans are available from several types of lenders—thrift institutions*, commercial banks, mortgage compa- nies, and credit unions. Different lenders may. They tend to offer good terms and interest rates, and some even allow a downpayment of as little as 3%. However, a higher down payment usually gets you better. Discover our mortgage calculators to find the best rates from lenders across Canada. Which Mortgage is the only independent Canadian mortgage advice. Choose the right mortgage option for you. Understanding Your Mortgage Types. Make an informed decision that best fits your needs. Fixed rate mortgages. Locked. Understanding Common Types of Mortgage Loans · Fixed-Rate Mortgage: This mortgage type has an interest rate that stays the same for the life of the loan. Best mortgage lenders · Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination. Find the right mortgage loan program for your situation. Knowing your options is a good first step. Explore home loan types and mortgage loan options. Nonfixed-rate mortgages are a possible option for borrowers who are comfortable with their ability to handle payment increases. They can also be a good option. But if interest rates go up, so will the cost of borrowing. The good news is our variable rate closed mortgages can be converted to a fixed rate mortgage at any.

Investment Companies For Beginners

They will host your Individual Savings Account (Isa) or Self-Invested Personal Pension (Sipp) and enable you to fill them with stocks, funds and ETFs to. Best Brokers for Beginners Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use. Free to read. Discover the top cheapest and simplest investment platforms for beginners. Find out how to get started investing and build your own portfolio. Stockpile Investments aggregates customer orders and submits trades for execution by our clearing firm at pre-set times. Therefore, the price you receive may. REIT Investing: A real estate investment trust (REIT) is a company that owns and manages income-producing properties. Investors can then purchase shares in REIT. Easy steps to start investing online · 1 · Open an account · 2 · Put money in · 3 · Pick an investment · 4 · Place your trade. There are many factors to consider as you prepare to open an investment account, including what type of investor you want to be and which brokerage firm is. Stocks. Invest in publicly traded companies and start customizing your investment portfolio today. To invest in stocks, open an online brokerage account, add money to the account, and purchase stocks or stock-based funds from there. They will host your Individual Savings Account (Isa) or Self-Invested Personal Pension (Sipp) and enable you to fill them with stocks, funds and ETFs to. Best Brokers for Beginners Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use. Free to read. Discover the top cheapest and simplest investment platforms for beginners. Find out how to get started investing and build your own portfolio. Stockpile Investments aggregates customer orders and submits trades for execution by our clearing firm at pre-set times. Therefore, the price you receive may. REIT Investing: A real estate investment trust (REIT) is a company that owns and manages income-producing properties. Investors can then purchase shares in REIT. Easy steps to start investing online · 1 · Open an account · 2 · Put money in · 3 · Pick an investment · 4 · Place your trade. There are many factors to consider as you prepare to open an investment account, including what type of investor you want to be and which brokerage firm is. Stocks. Invest in publicly traded companies and start customizing your investment portfolio today. To invest in stocks, open an online brokerage account, add money to the account, and purchase stocks or stock-based funds from there.

Iphone screen showing the portfolio breakdown of investments made in the Stash app. Companies invested. Invest your way. Invest on your own terms. Start. Acorns helps you save & invest. Invest spare change, bank smarter, earn bonus investments, and more! Get started. Stocks. Invest in publicly traded companies and start customizing your investment portfolio today. In addition to investing in a retirement account, you can also buy and sell securities in a brokerage account. Brokerage accounts are similar to bank accounts. Some online trading platforms cater to beginners, like SoFi Invest, Robinhood, Webull and M1 Finance. These brokerage accounts for beginners charge no fees to. Only authorized participants (financial institutions who double as broker-dealers) own direct shares of these investment funds. But these authorized. If you want one-stop shopping: By banking with Merrill Edge parent Bank of America, you can easily transfer money between your checking and investment accounts. There are many other types of investments and financial vehicles: bonds, money market funds, certificates of deposit through a brokerage account or investment. Filter and select the ones that suit your investment needs, or start with our expert's Mutual Fund Screened List. Compare your portfolio against 9 asset. How to Start Investing in Stocks in · Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your. beginner to advanced investors. Robust investment performance reporting funds, ETFs, and other forms of investment through various stock exchanges. Along with Fidelity, Schwab is probably one of the two best investment companies when it comes to research and investment tools. Schwab also gets a gold star. Investments are commonly made in stocks, bonds, mutual funds, and physical assets such as real estate. Investing is a crucial element of personal finance. Ask yourself what you want to achieve. Is your goal a down payment on a house? Are you saving for retirement? Or do you just want to get started and learn how. Rowe Price website, and select "Transactions" under the "My Accounts" tab. From here you can start trading stocks, ETFs, options, or mutual funds. Unlock financial success with Schwab's wealth management and brokerage services. Invest in stocks, mutual funds, bonds, and more. Start Today! 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. Only authorized participants (financial institutions who double as broker-dealers) own direct shares of these investment funds. But these authorized. In the same way, you can fill your account with investment products such as mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more. The first step.

Chart Analysis Stocks

Learn the assumptions that guide technical analysis, and get to know the basics of trend trading. Understanding Indicators in Technical Analysis. Identify the. In my experience, those new to technical analysis tend to see head-and-shoulders patterns everywhere. That's why taking the time to confirm signals, such as. Chart analysis, also known as technical analysis, is a methodology used by traders and investors to make decisions in financial markets. Chart and Candlestick Patterns, Advanced Technical Indicators – our platform provides the tools you need to master technical analysis. Learn and Grow. Explore. Technical analysis is concerned with price action, which gives clues as to the stock's supply and demand dynamics – which is what ultimately determines the. Plot option charts with the underlying stock to see the relationship between the two. Now you can plot bid/ask data or last-trade data. This makes beautiful. Our professional live stocks chart gives you in depth look at thousands of stocks from various countries. Indicators are approaches to analyzing the charts. While the tools can be used on a standalone basis, many analysts, fund managers, and investors will find. The day moving average is considered by most analysts as a critical indicator on a stock chart. Traders who are bullish on a stock want to see the stock's. Learn the assumptions that guide technical analysis, and get to know the basics of trend trading. Understanding Indicators in Technical Analysis. Identify the. In my experience, those new to technical analysis tend to see head-and-shoulders patterns everywhere. That's why taking the time to confirm signals, such as. Chart analysis, also known as technical analysis, is a methodology used by traders and investors to make decisions in financial markets. Chart and Candlestick Patterns, Advanced Technical Indicators – our platform provides the tools you need to master technical analysis. Learn and Grow. Explore. Technical analysis is concerned with price action, which gives clues as to the stock's supply and demand dynamics – which is what ultimately determines the. Plot option charts with the underlying stock to see the relationship between the two. Now you can plot bid/ask data or last-trade data. This makes beautiful. Our professional live stocks chart gives you in depth look at thousands of stocks from various countries. Indicators are approaches to analyzing the charts. While the tools can be used on a standalone basis, many analysts, fund managers, and investors will find. The day moving average is considered by most analysts as a critical indicator on a stock chart. Traders who are bullish on a stock want to see the stock's.

Get the latest stock technical analysis of stock/share trends, BSE/NSE technical chart, live market map and more technical stock information at. Overall, our AI plays a starring role in reading and analyzing stock charts by leveraging machine learning, deep learning, and natural language processing. The best free stock charts are on TradingView. Other free charting websites include azs-2022.ru, FINVIZ, Stock Rover and Yahoo Finance. Free technical analysis and stock screen using tools like fibonacci numbers, volume analysis, candlestick charting and market indicators. Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are. In my experience, those new to technical analysis tend to see head-and-shoulders patterns everywhere. That's why taking the time to confirm signals, such as. When making investment decisions, it helps to analyze a stock, stock index, or exchange-traded fund (ETF) relative to its past price action. And one way to do. Stock charts show you a history of a stock's price and volume over a period of time. Trained investors use stock charts to spot trends and buy/sell signals in. United States Stock Market IndexQuote - Chart - Historical Data - News. Summary; Stats; Forecast; Alerts. US stocks finished the last trading day of August on a. Technical Analysis Charts are used by traders and investors to predict, analyse, sustain and develop a trend in the market. Stocks chart in India are the. Stock chart patterns, when identified correctly, can be used to identify a consolidation in the market, often leading to a likely continuation or reversal trend. More Charting Tools · Sample Chart Gallery · Point & Figure · GalleryView · Seasonality · CandleGlance · MarketCarpets · PerfCharts · RRG Charts. A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Chart patterns are a commonly-used tool in the analysis of financial data. Analysts use chart patterns as indicators to predict future price movements. Charts also help technical analysts to decide on entrance and exit points, and at what prices to place stops to reduce risk. The main chart types used by. Investors often consider trading volume, or the number of shares changing hands in a public market, to be integral to their analysis. Volume can provide a clue. Our top 11 stock chart trading patterns list can be used on most financial markets and may be a useful place to start if you're new to technical analysis. Free technical analysis and stock screen using tools like fibonacci numbers, volume analysis, candlestick charting and market indicators. A chart pattern is a set price action that is repeated again and again. The idea behind chart pattern analysis is that by knowing what happened after a pattern. Technical Analysis. Coffee Could Be on the These Stocks Stand to Lose. Andrew Addison. August 12, pm ET. The commodity's monthly closing chart.

Diversify Portfolio Meaning

Diversification can be neatly summed up as, “Don't put all your eggs in one basket.” The idea is that if one investment loses money, the other investments. Portfolio diversification concerns the inclusion of different investment vehicles with a variety of features. The strategy of diversification requires balancing. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt to limit exposure to any single asset or risk. Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. Diversification is a strategised form of risk management. It's a technique that incorporates an assortment of investments that are part of a portfolio. Portfolio diversification is a simple concept. In essence, it refers to the practice of investing your money in a range of different securities and asset. Diversification reduces the risk of major losses that can result from over-emphasizing a single security or single asset class, however resilient you might. We believe that you should have a diversified mix of stocks, bonds, and other investments, and should diversify your portfolio within those different types of. Diversifying your portfolio simply means reducing your investment risk by not putting all of your eggs in one basket. Diversification can be neatly summed up as, “Don't put all your eggs in one basket.” The idea is that if one investment loses money, the other investments. Portfolio diversification concerns the inclusion of different investment vehicles with a variety of features. The strategy of diversification requires balancing. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt to limit exposure to any single asset or risk. Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. Diversification is a strategised form of risk management. It's a technique that incorporates an assortment of investments that are part of a portfolio. Portfolio diversification is a simple concept. In essence, it refers to the practice of investing your money in a range of different securities and asset. Diversification reduces the risk of major losses that can result from over-emphasizing a single security or single asset class, however resilient you might. We believe that you should have a diversified mix of stocks, bonds, and other investments, and should diversify your portfolio within those different types of. Diversifying your portfolio simply means reducing your investment risk by not putting all of your eggs in one basket.

Diversification is a risk management technique that mitigates risk by allocating investments across different financial instruments, industries, and several. Diversification is a risk management technique that mitigates risk by allocating investments across different financial instruments, industries, and several. In simple terms, portfolio diversification is the practice of not putting all of your eggs in one basket. A diversified portfolio is one in which your. A diversified portfolio includes investments within asset classes and across classes, in various industriesand in both foreign and domestic markets. One. It is a management strategy that blends different investments in a single portfolio. The idea behind diversification is that a variety of investments will yield. Diversification is the practice of dividing your money among lots of different types of investments. It's the investing version of spreading your bets. Portfolio Diversification means spreading your investments across a diverse range of asset classes to minimize risk and enhance returns of overall. Diversification is an investment strategy that lowers your portfolio's risk and helps you get more stable returns. You diversify by investing your money. Diversification is a common risk management strategy. Learn how you can diversify your portfolio by spreading your money between different types of. Diversification is a strategy in which you spread your investments across different asset classes, industries, or even geographic regions to reduce risk. A diversified portfolio is a collection of different investments that combine to reduce an investor's overall risk profile. Diversification includes owning. In order to mitigate risks, it's generally considered to be a good idea to diversify one's portfolio, meaning to balance a portfolio and add variety. Portfolio diversification is the process of spreading your investments across different asset classes, sectors, regions, and strategies to reduce your exposure. A portfolio that includes a variety of securities so that the weight of any security is small. The risk of a well-diversified portfolio closely approximates the. Investment diversification protects your portfolio from adverse stock market conditions. But how should I diversify my portfolio? Updated 3/26/ Why. As the name suggests, the basic definition of portfolio diversification is that it involves spreading investments across a broad selection of assets in order. Portfolio diversification is a risk-management strategy that involves trading or investing in a variety of different assets in order to reduce the risk of poor. This is diversification - A type of investment strategy that reduces risk by spreading an investment portfolio across different financial products. Diversification is the technique of spreading investments across several different assets to help minimize risk. This can mean mixing different investment. A diversified portfolio contains a mix of many different stocks, bonds, and alternative investments. Mutual funds and ETFs are easy ways to seek diversification.

How Can I Flip 200 Dollars

Fastest Ways To Make $ · #1. Sell Something on Craigslist or Facebook Marketplace · #2. Take Online Surveys That Pay Cash Instantly · #3. Sell Gift Cards or. Once you have a goal in mind, the main choices you need to make are what type of account to use, how much money to invest, and what to invest it in. Consider flipping items by sourcing low-cost goods from thrift stores or garage sales and selling them online. Explore freelancing opportunities. 6 likes, 5 comments - tradingyoda am August 29, "This day trading strategy can turn dollars into dollars in one afternoon What. With a year investment perspective, you are considered to be a long-term investor. Put your money in the stock market, directly or through mutual funds. dollars off 4 dollars ain't a bad flip. Travis Robinson · Original audio. What you wanna do is. you wanna pay your workers $ every day. My workers get paid $ every day. They clean about one to two thousand dollars. depending on. Listen to money flip victim Shonique, who actually got herself into a double flipcash whammy: Long story short I'm out $ dollars. And here's Nkoye's money. Top 25 Ways to Make $ a Day · Take Online Surveys · Invest · Deliver food · Drive for Uber and Lyft · Freelance on Fiverr or Upwork · Pet Sit · Babysit · Be an. Fastest Ways To Make $ · #1. Sell Something on Craigslist or Facebook Marketplace · #2. Take Online Surveys That Pay Cash Instantly · #3. Sell Gift Cards or. Once you have a goal in mind, the main choices you need to make are what type of account to use, how much money to invest, and what to invest it in. Consider flipping items by sourcing low-cost goods from thrift stores or garage sales and selling them online. Explore freelancing opportunities. 6 likes, 5 comments - tradingyoda am August 29, "This day trading strategy can turn dollars into dollars in one afternoon What. With a year investment perspective, you are considered to be a long-term investor. Put your money in the stock market, directly or through mutual funds. dollars off 4 dollars ain't a bad flip. Travis Robinson · Original audio. What you wanna do is. you wanna pay your workers $ every day. My workers get paid $ every day. They clean about one to two thousand dollars. depending on. Listen to money flip victim Shonique, who actually got herself into a double flipcash whammy: Long story short I'm out $ dollars. And here's Nkoye's money. Top 25 Ways to Make $ a Day · Take Online Surveys · Invest · Deliver food · Drive for Uber and Lyft · Freelance on Fiverr or Upwork · Pet Sit · Babysit · Be an.

How Much to Invest to Have Million Dollars? Saving up an enormous $ million from investing isn't small beans. It demands a significant initial investment. If you need to make $ fast, you have a couple options. The first is to provide some sort of freelance service, which could be anything from mowing lawns to. Don't Have Enough Cash to Flip a House? They could easily add up to $ (or more), so even if you sell for $2, — double what you paid — and you make $ , $1,, $1,, $, , $1,, $1,, $, Investing is the act of using money to make more money. The Investment. Flipping in its simplest form is buying an item for one price and then selling the item on for more money, resulting in profit for you. Whether you want to be your own boss or just to shore up some extra cash, there are several cheap businesses you can start with little in the way of money. Sure. So if you risk $, try to make $ on this trade. Yes, this is very If anyone can double there money consistently than I guess I am doing it wrong. If you already have a collection of high-end bags (lucky you!) or are willing to spend the time required to find good deals on them, you can make extra money by. investment goals. In this comprehensive guide, we'll delve into the best way to invest K and how to make your money work for you through various avenues. Become A Freelancer · Be A Personal Grocery Shopper With Instacart · Rent Out Your RV While Not In Use · Make Money By Delivering Food & Stuff · Help People With. M件の投稿。How to Flip Dollars関連の動画をTikTokで探そう。 How to Start Nft with Dollars, How to Make Dollars, How to Flip , How to. One word - Udemy. Find something that inspires and helps you grow. Wait for it to go on ridiculous sale (like $ to $15) - it always does. This will. The classic approach of doubling your money involves investing in a diversified portfolio of stocks and bonds and is probably the one that applies to most. 6 likes, 5 comments - tradingyoda am August 29, "This day trading strategy can turn dollars into dollars in one afternoon What. As a new investor, you'll still be learning your way around the investment landscape, and if you are tempted to risk more money than you can afford when your. How to Double Dollars (7+ EASY Ways) · Investing in Real Estate with Arrived · Invest in Stocks with Acorns · Invest in Cryptocurrency with Binance · Flip. You can buy things from a thrift store, sell them online and make a neat profit. You don't need a lot of experience or special skills to flip items, but you. Check out our dollars selection for the very best in unique or custom, handmade pieces from our coins & money shops. Now it's YOUR turn! I invite you to join the 2 Days Dollars challenge. What can you do in your home to drastically improve a space without investing a ton. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments.

What Does Attorney In Fact Mean

Your attorney-in-fact must be careful with your money and other property. State laws require an attorney-in-fact to act as a prudent person would under the. In any power of attorney, you are considered to be the “principal” and the person to whom you assign the power is your “agent” or “attorney-in-fact.” Your. The meaning of ATTORNEY-IN-FACT is an attorney who may or may not be a lawyer who is given written authority to act on another's behalf especially by a. Who Should I Choose as My Attorney in Fact? An attorney in fact (AIF) is an agent authorized to act on behalf of another person. Your AIF will handle your. An attorney-in-fact, also known as an agent, does not require any special qualifications. That means the person you appoint can be a friend, family member, or. A “General” Power of Attorney gives the Attorney-in-Fact very broad powers to do almost every legal act that the Principal can do. When an Elder Law Attorney. In most cases, when there are multiple attorneys-in-fact they are appointed severally, meaning that they can each act independently of one another. Nevertheless. A guardian or conservator is somebody who is appointed through court intervention in instances where there is no less restrictive means of intervention. An Attorney-in-Fact is a person appointed by an individual (known as the principal) who is legally empowered to act on their behalf for legal or financial. Your attorney-in-fact must be careful with your money and other property. State laws require an attorney-in-fact to act as a prudent person would under the. In any power of attorney, you are considered to be the “principal” and the person to whom you assign the power is your “agent” or “attorney-in-fact.” Your. The meaning of ATTORNEY-IN-FACT is an attorney who may or may not be a lawyer who is given written authority to act on another's behalf especially by a. Who Should I Choose as My Attorney in Fact? An attorney in fact (AIF) is an agent authorized to act on behalf of another person. Your AIF will handle your. An attorney-in-fact, also known as an agent, does not require any special qualifications. That means the person you appoint can be a friend, family member, or. A “General” Power of Attorney gives the Attorney-in-Fact very broad powers to do almost every legal act that the Principal can do. When an Elder Law Attorney. In most cases, when there are multiple attorneys-in-fact they are appointed severally, meaning that they can each act independently of one another. Nevertheless. A guardian or conservator is somebody who is appointed through court intervention in instances where there is no less restrictive means of intervention. An Attorney-in-Fact is a person appointed by an individual (known as the principal) who is legally empowered to act on their behalf for legal or financial.

"Agent" means a person granted authority to act for a principal under a power of attorney, whether denominated an agent, attorney-in-fact, or otherwise. The. A power of attorney document allows someone that you select (your “attorney-in-fact” or “agent”) to act on your behalf in financial matters. It is common for a. An attorney in fact is an agent authorized to act on behalf of another person, but not necessarily authorized to practice law. An attorney-in-fact is a person who has been legally appointed to act on behalf of another person in a legal or business matter. An attorney-in-fact, also known as an agent, does not require any special qualifications. That means the person you appoint can be a friend, family member, or. The meaning of ATTORNEY-IN-FACT is an attorney who may or may not be a lawyer who is given written authority to act on another's behalf especially by a. cisions is called the “attorney-in-fact” and must agree to serve in this role. This person is different from an “attorney-at-law” who is licensed to represent a. The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact." With a valid power of attorney. A power of attorney (POA) is a legal document that allows you to designate someone to act in a legal capacity on your behalf. An attorney in fact is an agent who is authorized to act on behalf of another person but is not necessarily authorized to practice law. Their responsibilities. Definition: An "attorney-in-fact" is a person who is appointed to act on behalf of another person, typically in legal or financial matters. A power of attorney (POA) is a legal authorization that gives the agent or attorney-in-fact the authority to act on behalf of an individual referred to as the. If you give a Power of Attorney, you are called the principal and the person you give it to is called the agent or the attorney-in-fact. A paper giving a Power. A power of attorney is a legal document giving one person (the agent or attorney-in-fact) the right to make certain decisions for another (the principal). The. With the status of attorney in fact comes for the agent duties to act in the principal's best interests and with loyalty to the principal. As discussed later. An attorney in fact is an agent who is authorized to act on behalf of another person but is not necessarily authorized to practice law. Their responsibilities. A power of attorney is a legal document in which one person (called the principal) gives to another person (the agent, or sometimes called the attorney in fact. The person who is given the power to act on behalf of the principal is known as the attorney-in-fact. Thus, once a Power Of Attorney is executed by the. A power of attorney (POA) is a legal authorization that gives the agent or attorney-in-fact the authority to act on behalf of an individual referred to as the. An attorney in fact who elects to act under a power of attorney is under a duty to act in the interest of the principal and to avoid conflicts of interest.

Places To Go Visit

TO GO. Wyoming is a big state. It's nearly 98, square miles of towering mountains, rolling prairies, unique towns, and. Peruse these sample journeys for inspiration on places to visit and things to do. When you find something you like, save it with the heart icon. Utah is made up of vibrant and historic places to go, all surrounded by natural beauty. Picking the best ones to visit can be tough. Explore here for trip. It doesn't end there, though. With turtle nesting, jungle tours, hiking, and more, the opportunities for enjoying nature go on and on. Coco Beach: Beaches &. Your complete inspiration and travel planning guide to the state of Minnesota, with trip ideas, lodging, attractions, events, free brochures and more. If you are a travel pro and dream to explore all the best places to visit in the World, Singapore should be on your cards. Unabashedly the most beautiful. Lonely Planet reveals its top picks of places to travel in The top 10 countries, cities, regions, value destinations and sustainable spots around the. Just ask one of our luxury Travel Experts. They'll make it happen. atacama chile atacama desert chile. Travel Tips · Pacific Coast Highway (Highway 1) at southern end of Big Sur, California · North America · Sand Harbor, Lake Tahoe Nevada State Park. TO GO. Wyoming is a big state. It's nearly 98, square miles of towering mountains, rolling prairies, unique towns, and. Peruse these sample journeys for inspiration on places to visit and things to do. When you find something you like, save it with the heart icon. Utah is made up of vibrant and historic places to go, all surrounded by natural beauty. Picking the best ones to visit can be tough. Explore here for trip. It doesn't end there, though. With turtle nesting, jungle tours, hiking, and more, the opportunities for enjoying nature go on and on. Coco Beach: Beaches &. Your complete inspiration and travel planning guide to the state of Minnesota, with trip ideas, lodging, attractions, events, free brochures and more. If you are a travel pro and dream to explore all the best places to visit in the World, Singapore should be on your cards. Unabashedly the most beautiful. Lonely Planet reveals its top picks of places to travel in The top 10 countries, cities, regions, value destinations and sustainable spots around the. Just ask one of our luxury Travel Experts. They'll make it happen. atacama chile atacama desert chile. Travel Tips · Pacific Coast Highway (Highway 1) at southern end of Big Sur, California · North America · Sand Harbor, Lake Tahoe Nevada State Park.

Definitive guidebook and friendly tour-guide to the world's most wondrous places. Travel tips, articles, strange facts and unique events. Bays De Noc: Over 1, acres of water on this freshwater shoreline. Fayette Historic State Park: Discover one of the iron smelting boom towns that went bust. Official state travel, tourism and vacation website for Florida, featuring maps, beaches, events, deals, photos, hotels, activities, attractions and other. New England's constituent states have a wealth of places to visit, which can provide glimpses into the region's complex history and culture. Explore the most popular and trending places to travel around the world, based on reviews by millions of real travelers. Popular places to visit in the South · Atlanta · Louisiana State Capitol Building in Baton Rouge. Baton Rouge · Charleston, South Carolina. Charleston · Jekyll. Places to Go. Beaches. Frolic in sand and surf on the southwest Places To Go. A white map of Washington with the Palouse region. From Giza to Tampa, here are the locales that made TIME's list of the greatest places in the world What to Do When Your Travel Plans Go South · The Best. Official state travel, tourism and vacation website for Florida, featuring maps, beaches, events, deals, photos, hotels, activities, attractions and other. Visitors can travel to these old places on the state's beautiful scenic byways, stopping at one (or several) of New Mexico's national and state parks and. Whether you're looking for a day trip, weekend escape, romantic getaway, or budget-friendly trips, find travel inspiration and itineraries by exploring our Best places to visit in the U.S. · New York City · Los Angeles, California · Las Vegas, Nevada · Grand Canyon, Arizona · Niagara Falls, New York · Statue of Liberty. Wherever you're headed, but sure to plan for the weather in your dream winter destination. American West Arizona Cabins Family Travel Hiking Hot Springs. Best Places to travel in Lisbon, Portugal - Albuquerque, New Mexico - Alexandria, Virginia - Atlanta, Georgia - Barcelona, Spain - Cape Charles. Alaska Destinations. So much to see! You can't go wrong starting with a visit to Kenai Fjords and Denali National Park. View of sea lions from aboard a day. Download the Visit Norway app. Get expert tips on thousands of places to stay, restaurants, activities, and attractions all over Norway. iPhone: Visit Norway. Roaring Camp & Big Trees Narrow Gauge Railroad. Travel over trestles, through towering redwood groves and up a winding narrow-gauge grade as conductors narrate. 1. Grand Canyon Probably one of the most iconic USA bucket list destinations is to visit the Grand Canyon out west. Located in Arizona, there are various ways. Wisconsin is home to many desirable travel locations from big cities to national parks, offering a range of sights and attractions for thrill seekers, nature.

Pre Approval Pre Qualified

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

A pre-approval is a preliminary evaluation of a potential borrower by a lender to determine whether they are likely to be approved for a loan or credit card. A mortgage pre-approval provides a fairly accurate estimate of a homebuyer's purchasing power, as it includes the maximum loan amount and interest rate the. The biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more. Pre-qualification is the initial step in the process. This is when a lender looks at your income and debts to see if you're eligible for a mortgage. A mortgage pre-approval provides a fairly accurate estimate of a homebuyer's purchasing power, as it includes the maximum loan amount and interest rate the. Getting pre-approved is crucial early in your home buying process. It provides you with a clear understanding of how much of a loan you qualify for. A pre-approval indicates that you are serious about buying, so sellers will take you seriously compared to a potential buyer who is pre-qualified. The pre-. Pre-approval is an important step to buying a home. Get pre-approved today and enjoy a day rate guarantee – it's free and there's no commitment! A Breakdown of the Differences Between Pre-Qualified and Pre-Approved. While pre-qualification and pre-approval both provide mortgage amounts that a borrower. A pre-approval is a preliminary evaluation of a potential borrower by a lender to determine whether they are likely to be approved for a loan or credit card. A mortgage pre-approval provides a fairly accurate estimate of a homebuyer's purchasing power, as it includes the maximum loan amount and interest rate the. The biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more. Pre-qualification is the initial step in the process. This is when a lender looks at your income and debts to see if you're eligible for a mortgage. A mortgage pre-approval provides a fairly accurate estimate of a homebuyer's purchasing power, as it includes the maximum loan amount and interest rate the. Getting pre-approved is crucial early in your home buying process. It provides you with a clear understanding of how much of a loan you qualify for. A pre-approval indicates that you are serious about buying, so sellers will take you seriously compared to a potential buyer who is pre-qualified. The pre-. Pre-approval is an important step to buying a home. Get pre-approved today and enjoy a day rate guarantee – it's free and there's no commitment! A Breakdown of the Differences Between Pre-Qualified and Pre-Approved. While pre-qualification and pre-approval both provide mortgage amounts that a borrower.

Pre-approvals are done prior to having an accepted offer for a property to give clients an estimate of the mortgage they may qualify for. 4. Get pre-approved. After you choose your guaranteed rate, you'll receive a certificate and pre-approval letter. Your mortgage pre-approval is good for 6. How much should I borrow for a home loan? nbkc offers both mortgage prequalification and mortgage pre-approval. It's important to understand the difference. What's the difference between mortgage preapproval and mortgage prequalification? Prequalification, Preapproval. Based on financial information you provide. A mortgage prequalification is a quick and simple way to find out how much you could borrow, and what your estimated rate and payment would be. A pre-qualification is a good starting place because it doesn't include an inquiry into your credit report and doesn't ask for proof of assets, income or debts. Pre-approval establishes the mortgage amount you may qualify for. It also guarantees the interest rate for up to days from the date of the certificate1. Pre-qualification is a faster process that requires much less paperwork, plus it's almost always free and doesn't impact your credit score. Pre-approval is a hard number for a loan amount. You receive pre-approval after lenders conduct a credit check and review your completed mortgage application. Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, you're getting an estimate of what you might be able to. What is Pre-Qualification? This is the first stage in the approval process. This is the step where your mortgage broker looks at your total income and debt and. Unlike pre-qualification, the pre-approval certifies that a lender (National Bank) is committed to providing you with financing. Enjoy the benefits of a pre-. Pre-approval comes later and is far more complex than pre-qualification. To get pre-approved, the borrower must complete a mortgage application and provide the. This will put you in a better position as a buyer. It is important to understand the distinction between being "prequalified" and "pre-approved" for a loan. The. Mortgage pre-qualification is the first step to pre-approval. It helps you figure out approximately how much you'll be able to borrow and how much you'll need. Securing a mortgage pre-approval letter or getting pre-qualified by a lender are effective ways of reducing the stress. But how do they differ, and is one. A pre-approved mortgage means a lender has reviewed your financial history and determined you may qualify for a loan up to a certain amount. Important note: A prequalification or preapproval does not guarantee approval from a lender. However, it will give you a good idea of your potential approval. Pre-qualification is the act of working with a lender to see what kind of mortgage you might qualify for based on your current personal finances.

Vehicle As Collateral For A Loan

If you want to use your car as collateral, we can let you know how much money you can borrow, your interest rate and your approximate loan repayment amount. Put your vehicle to work with Car Collateral Loans and drive away with cash from $$! Available in Phoenix, Mesa, Tempe and Glendale, Arizona. Car title loans are very easy to get approved, regardless of your credit score, as long as you put up your own vehicle as collateral. If this seems like a type. If you are in need of funds and have a car that you own outright, you may be able to use it as collateral to obtain a secured personal loan. Using your car as. You need to provide the lender a clear title (showing no other liens) to your vehicle, which serves as collateral for the loan. You will need to show your. You may be able to take a loan out against a car (or another vehicle) if you meet the lender's criteria. This is known as a logbook loan. Be aware, they tend to. A title loan is a secured loan that uses your vehicle's title as collateral. When you're approved for a title loan, you hand over your title to the lender who. The same is true for auto loans in many cases. The collateral for the loan is the vehicle that the loan is taken on. If the borrower fails to make the agreed-. We offer Southern California with car collateral loans that are quick, easy, and affordable. Our loan specialists are trained to accurately appraise the value. If you want to use your car as collateral, we can let you know how much money you can borrow, your interest rate and your approximate loan repayment amount. Put your vehicle to work with Car Collateral Loans and drive away with cash from $$! Available in Phoenix, Mesa, Tempe and Glendale, Arizona. Car title loans are very easy to get approved, regardless of your credit score, as long as you put up your own vehicle as collateral. If this seems like a type. If you are in need of funds and have a car that you own outright, you may be able to use it as collateral to obtain a secured personal loan. Using your car as. You need to provide the lender a clear title (showing no other liens) to your vehicle, which serves as collateral for the loan. You will need to show your. You may be able to take a loan out against a car (or another vehicle) if you meet the lender's criteria. This is known as a logbook loan. Be aware, they tend to. A title loan is a secured loan that uses your vehicle's title as collateral. When you're approved for a title loan, you hand over your title to the lender who. The same is true for auto loans in many cases. The collateral for the loan is the vehicle that the loan is taken on. If the borrower fails to make the agreed-. We offer Southern California with car collateral loans that are quick, easy, and affordable. Our loan specialists are trained to accurately appraise the value.

Car title loans are short-term secured loans that use the borrower's car as their collateral. · They are associated with subprime lending, as they often involve. Collateral loans for cars are similar to home loans. In this instance, you'll use your vehicle as collateral to guarantee that you'll repay the loan according. Lending Act (MLA) may not pledge a vehicle as collateral. If covered by the MLA, you are not eligible for a secured loan. Loan proceeds cannot be used for. We write loans using antique or classic cars as collateral. Contact us today and get your equity out quick! Call You, in theory, could leverage any equity you have in the vehicle into more debt. So, like, if the car is worth 20k and your loan is $15k. A title loan is a loan that uses the value of your automobile to secure the loan, also known as collateral. You must provide the lender with your automobile. Vehicle Collateral LOANS Instantly access cash without the wait! Unlock quick financial relief using your car title with us. Your vehicle is more than just a. COLLATERAL LOANS. Different from an unsecured personal loan or auto loan, a collateral loan allows you to borrow against your vehicle title with no lien. You get to keep it. If you face a financial crisis, applying for a car collateral loan in Vancouver is the right choice. You can borrow up to $50, You must. With a title loan, you can borrow money by leveraging the value of your vehicle. The lender holds the title to your car until the loan is repaid in full. If you. Using a car as collateral for a loan. It is possible to use your car as collateral on a loan. This means you offer up the car as security so if you default on. 3. Finova Finance A newer face on the scene, Finova Finance is a financial technology company founded in Finova Finance specializes in car equity lines. If you're still paying off a car loan, you can still use your vehicle as collateral if its equity meets the lender's standards. You can calculate your car's. When considering car title loans, your vehicle's title holds significant value. However, by having a financed car, it means the lender also has a vested. Collateral is a financial or physical asset—like property—that helps secure a loan. Learn more. How will such a loan work? When you offer your car as collateral for a loan to your bank, the bank will first need to know its current value. To determine this. Car title loans are short-term secured loans that use the borrower's car as their collateral. · They are associated with subprime lending, as they often involve. Ace loans canada offers car collateral loans in toronto up to $ at a very competitive interest rate. To Apply call us now at A Best Egg Vehicle Equity Loan empowers you to leverage the value of your car to secure a loan from $2, to $,, subject to credit approval. The minimum. What is a Luxury Car Collateral Loan? It is a form of a secured loan that give you a chance to borrow cash against the value of your luxury car if you own it.